Max Social Security Tax 2025 Withholding Nj. The social security administration (ssa) has announced that the maximum earnings subject to social security tax (social security wage base) will increase from. You aren’t required to pay the social security tax on any income beyond the social security wage base limit.

6.2% social security tax on the first $168,600 of employee wages (maximum tax is $10,453.20; Put in the number that corresponds to your.

How To Calculate, Find Social Security Tax Withholding Social, For 2025, an employer must withhold: If provisional income exceeds $34,000, up to 85% of.

50 Essential Tips Maximizing Tax Withholding on Social Security 2025, The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. If you are a single tax filer and your combined income is between $25,000 and $34,000, the ssa says you may have to pay income tax on up to 50% of your benefits.

Limit For Maximum Social Security Tax 2025 Financial Samurai, But you may pay federal taxes on a portion of your social security benefits, depending on your income. You worked hard during your career to provide income through your retirement.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, 6.2% social security tax on the first $168,600 of employee wages (maximum tax is $10,453.20; If you need more information about tax withholding, read irs publication 554, tax guide for seniors, and publication 915, social security and equivalent railroad retirement.

Social Security Maximum Taxable Earnings 2025 2025 DRT, If provisional income exceeds $34,000, up to 85% of. Put in the number that corresponds to your.

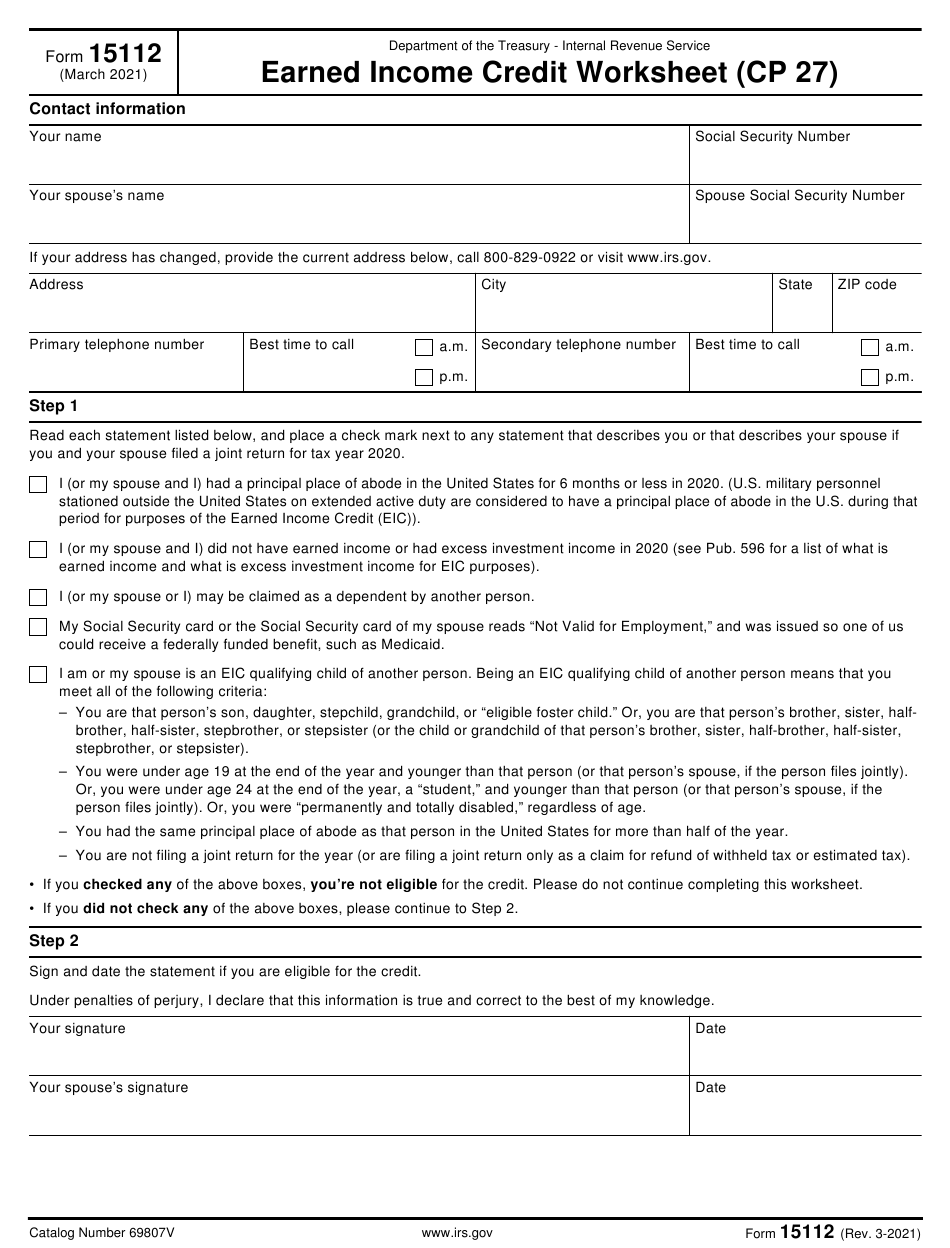

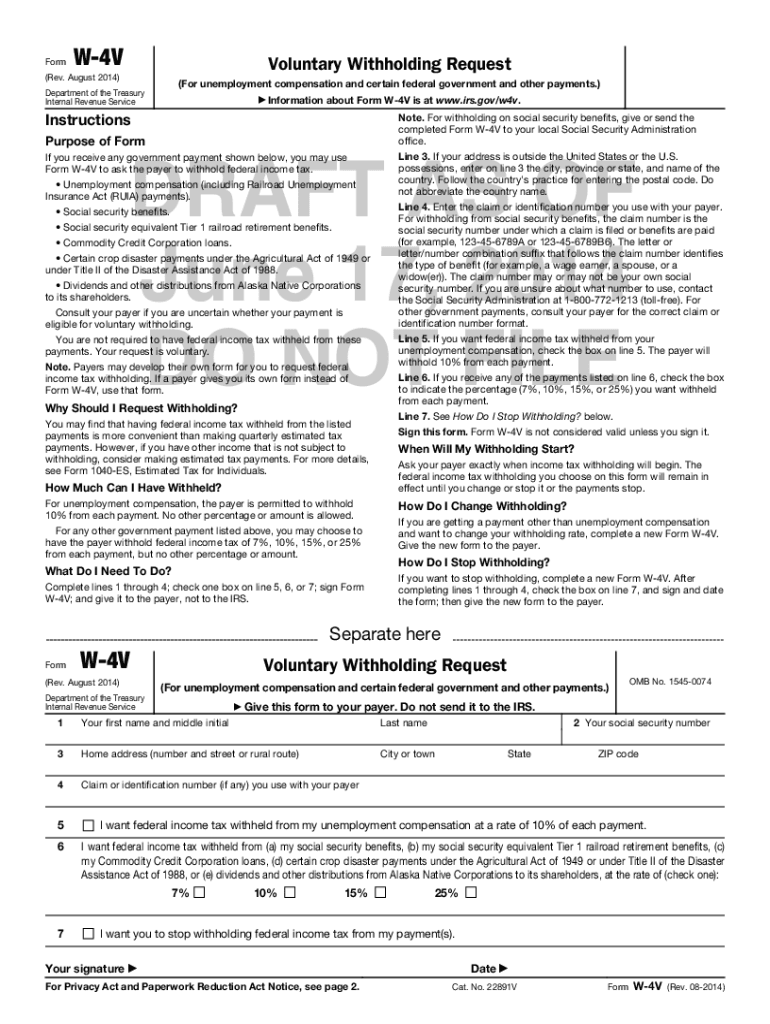

Social Security Tax Withholding Forms, 2025 maximum temporary disability insurance weekly benefit rate: You worked hard during your career to provide income through your retirement.

How To Calculate Social Security And Medicare Withholding, The new jersey tax calculator is updated for the 2025/25 tax year. In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600.

What Is The Max Social Security Tax For 2025 W2023E, In 2025, this limit rises to $168,600, up from the 2025. You worked hard during your career to provide income through your retirement.

Social Security Tax Withholding Form 2025, In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600. For provisional income between $25,000 and $34,000, up to 50% of social security benefits are taxable.

Social Security Withholding Calculator 2025 Tax Withholding Estimator, 2025 maximum temporary disability insurance weekly benefit rate: 2025 alternative earnings test amount for ui and tdi :