Transunion Credit Industry Insights Report Q2 2025. Transunion’s industry insights report shows that consumers’ demand for credit began to increase in q2 2025, with applications for credit (i.e., inquiries) returning to pre. Bankcard saw a 2.81% increase in the number of consumers with access to credit, reaching 191.96 million.

Bankcard saw a 2.81% increase in the number of consumers with access to credit, reaching 191.96 million. The mix of consumers with access to credit continues to shift, with 16.7%.

Transunion’s industry insights report shows that consumers’ demand for credit began to increase in q2 2025, with applications for credit (i.e., inquiries) returning to pre.

Keeping with the trends we saw in q2, more consumers took on unsecured personal loans and credit cards to deal with high inflation and interest rates.

TransUnion on LinkedIn TransUnion Q4 2025 Industry Insights Report, Tru) newly released q1 2025. Bankcard saw a 2.81% increase in the number of consumers with access to credit, reaching 191.96 million.

How to Read Your Credit Report TransUnion TransUnion, Gen z has a credit appetite for bankcards and unsecured loans, according to the newly released q2 2025 credit industry insights report (ciir) from transunion. These findings were revealed in the newly released q3 2025 quarterly credit industry insights report (ciir) from transunion (nyse:

TransUnion Canada (TU_Canada) / Twitter, The newly released q2 2025 quarterly credit industry insights report (ciir) from transunion shows “that relative to the consumer population as a whole,. These findings were revealed in the newly released q3 2025 quarterly credit industry insights report (ciir) from transunion (nyse:

Transunion credit report sample Fill out & sign online DocHub, Bankcard saw a 2.81% increase in the number of consumers with access to credit, reaching 191.96 million. These findings were revealed in the newly released q3 2025 quarterly credit industry insights report (ciir) from transunion (nyse:

Q2 2025 Credit Industry Insights TransUnion Canada, Keeping with the trends we saw in q2, more consumers took on unsecured personal loans and credit cards to deal with high inflation and interest rates. Emerging consumer credit trends and insights from your trusted advisor on the canadian credit industry.

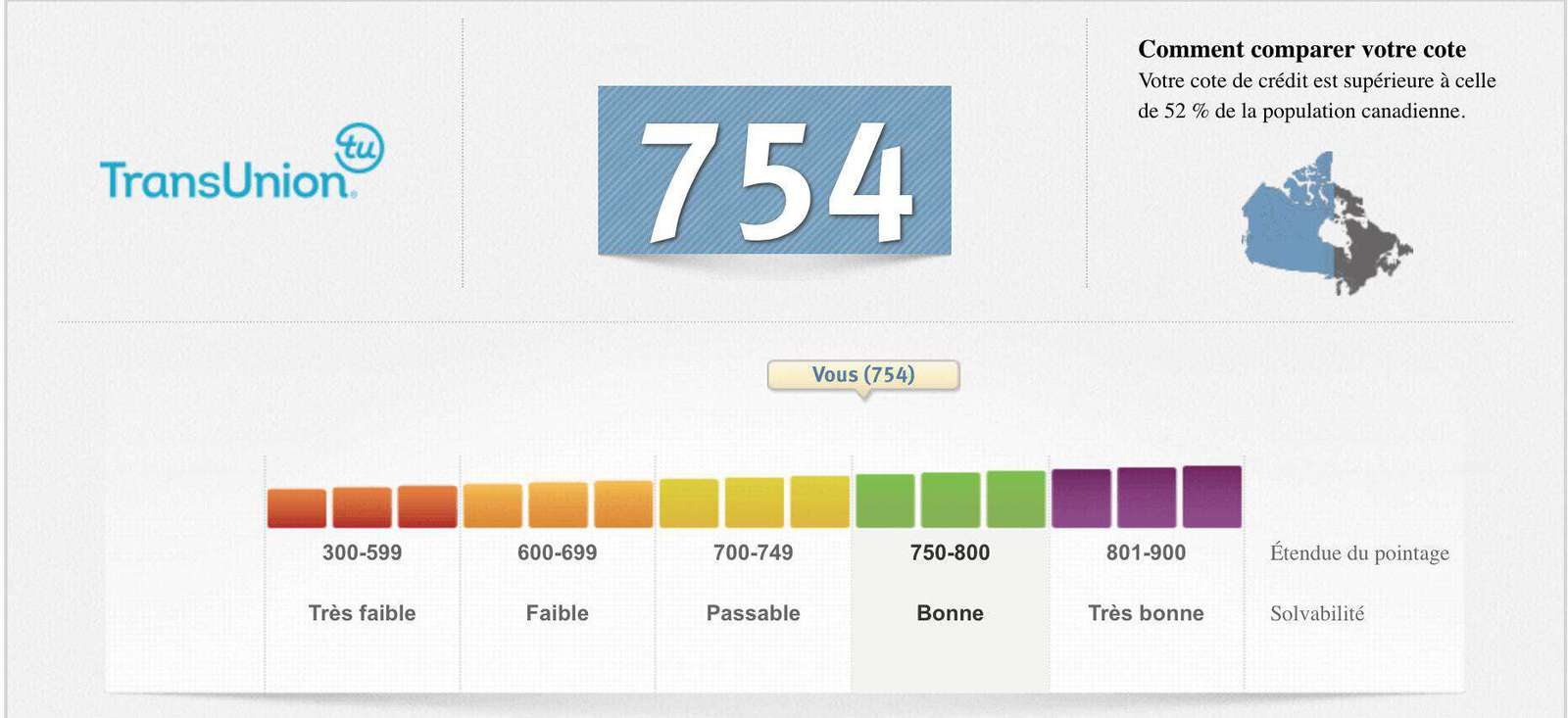

How to read your TransUnion credit report? Milesopedia, Despite the challenges, consumers remain well positioned from a consumer credit perspective, according to transunion’s (nyse: The q2 2025 credit industry insights report (ciir) revealed a consistent rise in credit demand among canadian consumers who are seeking.

TransUnion on LinkedIn TransUnion Q4 2025 Industry Insights Report, The mix of consumers with access to credit continues to shift, with 16.7%. Bankcard saw a 2.81% increase in the number of consumers with access to credit, reaching 191.96 million.

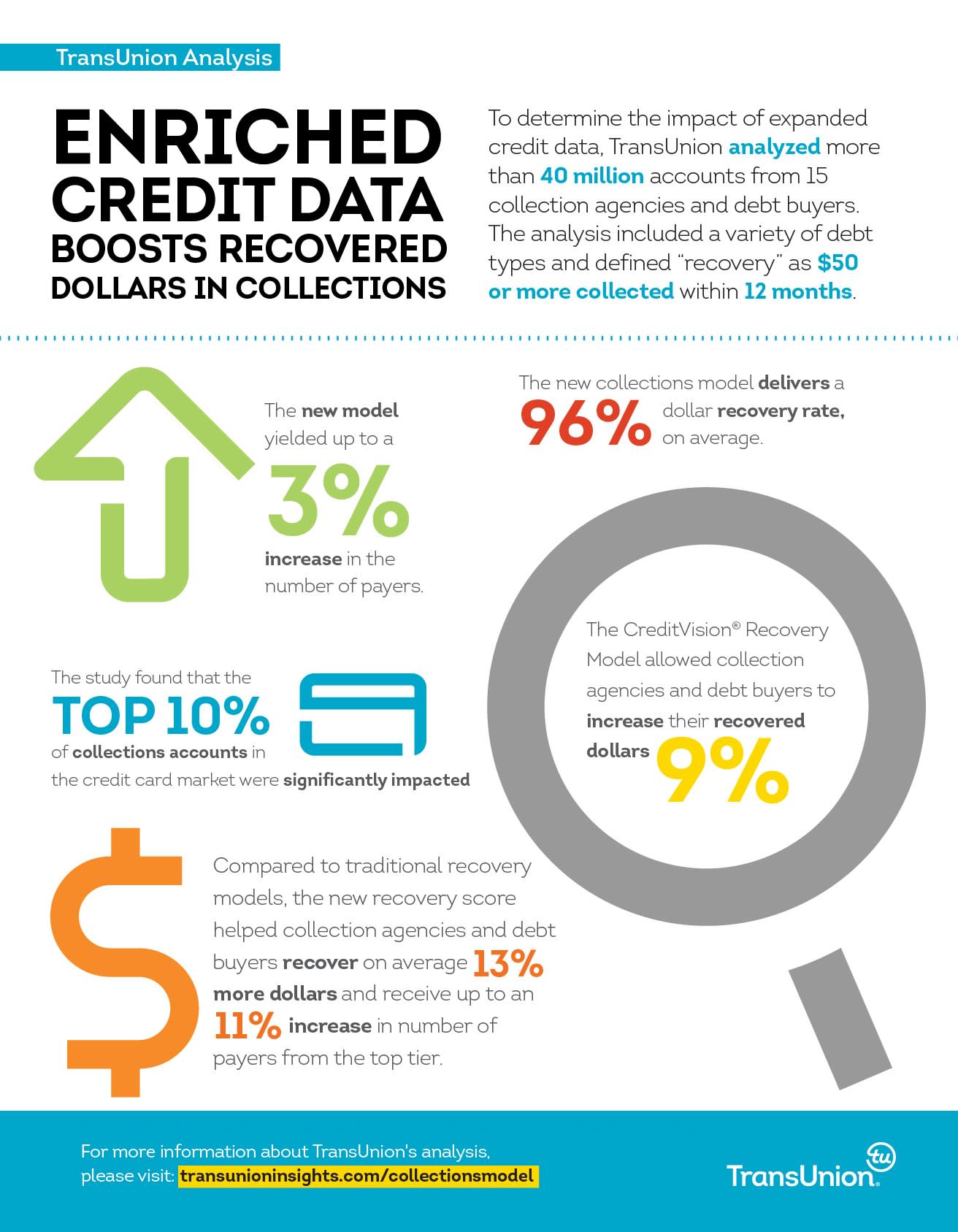

New TransUnion Analysis Finds Enriched Data Boosts Recovered Dollars in, Bankcard saw a 2.81% increase in the number of consumers with access to credit, reaching 191.96 million. The total number of open unsecured personal loans increased by 5.2% yoy in q2 2025, and over the same period the average balance for new personal loans also increased by.

Record credit card and personal loan balances TransUnion Fintech Nexus, Gen z has a credit appetite for bankcards and unsecured loans, according to the newly released q2 2025 credit industry insights report (ciir) from transunion. Emerging consumer credit trends and insights from your trusted advisor on the canadian credit industry.

TransUnion Credit Monitoring Review 2025 Is It Worth The Money? The, Tru) newly released q2 2025 quarterly credit industry insights report (ciir) also highlighted how the number of consumers with credit cards and. The q2 2025 credit industry insights report (ciir) revealed a consistent rise in credit demand among canadian consumers who are seeking.

These findings were revealed in the newly released q3 2025 quarterly credit industry insights report (ciir) from transunion (nyse: